AUDIT & ASSURANCE

We at S V R Y& Co., Bangalore conduct the Statutory, Tax, and Internal audits of Corporates and Non corporates like Start-up entities, Indian Corporates, Multi-National Companies (MNCs), Partnership firms, proprietary concerns, NGOs, Societies and Trusts.

We have been working with clients from different industries such as Information Technology (IT), ITES, manufacturing, pharmaceuticals, Ecommerce, automobiles, real estate, etc. We are also providing extensive services to start-up ventures, incubators, etc. In case you need these services, we would be glad to assist you. Please write to enquiry@svryca.com.

Statutory Audit

One of the main types of audits is a statutory audit. It is a legal requirement as per the state or national laws prevalent in the region. In India, the laws regarding a statutory audit are in the Companies Act, 2013.

A statutory is another name of a financial audit. It is essentially an audit of the final statements of a company, i.e. the profit and loss and the balance sheet. The purpose of a statutory audit is to ensure that these accounts of the company represent a fair and accurate picture of the company’s current financial position on the date of the balance sheet.

It is important that we understand the need for a statutory audit to be carried out. In case of a company, the owners of the company are the shareholders. However, they do not run or manage the day to day affairs of the company. This is done by the board of directors and the management of the company. So the shareholders need assurance that the accounts maintained and published by the company are authentic and genuine. This is why the law requires that an independent auditor to conduct a statutory audit.

The independent auditor has full authority to check the financial records of the company and publish his findings via an auditor’s report. The shareholders and owners of the enterprise can then be assured of the authenticity and reliability of the financial statements.

Other stakeholders like creditors, employees, potential investors etc also benefit from the statutory audit. They too can base their decisions on these accounts, since they are authentic.

Our approaches to Statutory Audit of the financial statements is to provide reasonable assurance that the accounts have been prepared in accordance with the Generally Accepted Accounting Principles (GAAP) and are free of any misstatements, errors and discrepancies. In addition to the traditional statutory audit, we also help the clients by monitoring organizational ethics, conducting effective reviews of operational and financial performance, assessing the quality, economy and efficiency of their operations and suggesting continuous improvement strategies.

At SVRY& Co., we have robust audit tools, resources and procedures to provide the means for our professionals to deliver high-quality audit services. In delivering these services we adhere to the highest standards of independence, professional objectivity and technical excellence thereby focusing on understanding the clients’ business and control issues from the inside out. It combines a rigorous risk assessment, diagnostic processes, and audit testing procedures as well as a continuous assessment of our clients’ service performance.

WE PROVIDE SPECIALIZED SERVICES IN STATUTORY AUDIT IN THE FOLLOWING:-

- Audit of financial statements: We recognize the management’s needs for submitting timely financial statements with conformity to the industry practices and rules and regulations. The company assists its clients by helping them prepare financial statements that reflect the client’s fair and transparent dealings while conducting any business transactions. The company assists in preparing financial statements like Cash Flow statement, Profit and Loss Account and Balance sheet for its clients

- Financial review: It helps in identifying the strengths and weaknesses of the financial accounting procedures and systems of the company. The deficiencies are addressed by suggesting suitable measures for improvement that ensure quality while meeting the industry accounting standards

Is statutory Audit compulsory?

In term of section 139(1) of the Companies Act, 2013 read with rule 3 of Companies (Audit and Auditors) Rules, 2014 every company shall appoint an individual or a firm as an auditor.

Section 139(6) of the Act stipulated that the first Auditor of the Company shall be appointed within 30 days of its date of registration.

Is IFRS applicable to private companies?

IFRS refers to International Financial Reporting Standards which are applied while preparing the financial statements of the company. Different countries have different accounting standards. In order to remove the discrepancy in Accounting across the Globe, countries world over decided to adopt uniform standards called IFRS.

In India, IND AS (Indian Accounting Standard converged with IFRS) has been introduced in 2014. The applicability of IND AS to companies is as under –

- Listed and Unlisted companies with net worthin excess of Rs.500 Crore (w.e.f. 1st April 2016) and holding, subsidiaryor associate and JV of the above companies.

- Listed (irrespective of the turnover) andUnlisted companies (private limited and closely held public companies)with net worth in excess of Rs.250 Crores (w.e.f. 1st April 2017) andholding, subsidiary or associate and JV of the above companies(irrespective of the turnover)

Once the company starts following IND AS, it shall be required to follow for the subsequent financial statements even if any of the criteria specified above does not subsequently apply to it.

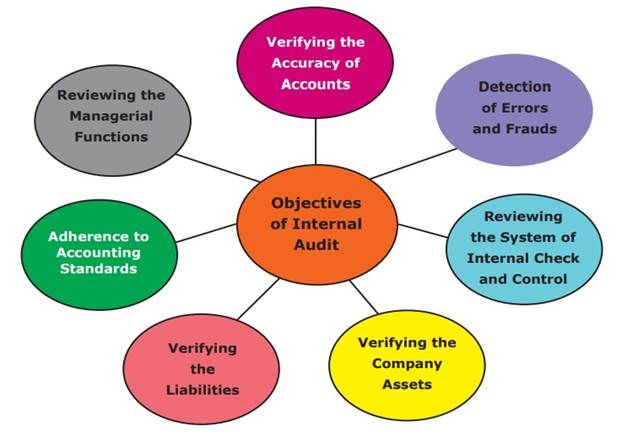

Internal Audit and Internal controls over Financial Reporting

In the wake of some severe corporate failures, expectations from Internal Audit are changing, and there is a clear shift in how organizations view their corporate governance and control environment. Share holders and audit committees are taking active interest in the effectiveness of Risk Management and Control Assurance areas in their organization. Stakeholders are increasingly demanding a higher degree of transparency and ethical behavior.

Today’s leading internal audit organizations are no longer limited to hazard avoidance and compliance. They need to demonstrate their knowledge on risk management, business process improvement, which is a characteristic of a consultant rather than a classical internal auditor. Furthermore, internal auditors are no longer required to focus solely on financial audits. They increasingly need to provide value adding support to managements across all areas of operation, for example, Information Technology, Purchase-to-Pay process, Order-to-Cash process, regulatory compliance, etc. To meet these challenges, a growing number of organizations are looking for strategic partners to support their internal audit requirements.

HOW WE CAN HELP

- We employ highly skilled professionals, who can help solve many of your common problems with the right solutions, contemporary processes/methodologies and superior tools/technologies.

- We can help organizations improve their quality and effectiveness of internal audit process by advising and assisting in the development of internal audit and risk management methodologies.

- Assessing whether the internal audit function is delivering effectively to stakeholders.

- Providing internal audit resourcing solutions, including full outsourcing or complementing in house functions with specialist skills or geographical coverage.

- Supporting internal audit functions with software to enhance and support their work.

- Training for internal auditors using our extensive market and industry knowledge.

The management of an organization may want the safety of having an independent audit team within the organization, that keeps a constant check on the accounting and finance practices. So they usually set up an internal audit. This is quite different from a statutory audit.

As per the name, an internal audit occurs within an organization. So an independent auditor or team of auditors, who are actually employees of the organization, will review the financing, accounting and operating activities of the organization. It is actually a part of the internal control system of the company.

For most organizations, the appointment of an internal auditor is completely mandatory. However, according to Rule 13 of the Companies (Accounts) Rules 2014 the following classes of companies are required by law to carry an internal audit,

- Every company listed on the stock market

- Every unlisted public company that has

- Paid up capital exceeding 50 crores in the previous year

- Turnover greater than 200 crores in the previous year

- If at any point in the previous year if outstanding loans and liabilities exceeded 100 crores

- Outstanding deposits exceeds 25 crores in the previous year

- And every private company that,

- Has a turnover of more than 200 crores in the previous year

- If at any point in the previous year if outstanding loans and liabilities exceeded 100 crores

Tax Audit

To discourage tax avoidance and evasion, the requirement of a tax audit was introduced by the Finance Act 1984, by inserting a new section “44AB” w.e.f. Assessment Year 1985-86. A Tax Audit involves an expression of the tax auditors’ opinion on the truth and correctness of certain factual details, given by assesses to the Income Tax Authorities to enable an assessment of tax.

Our endeavour is to mitigate the burden of tax and to review that disallowances and deductions if any, under the various provisions of Income Tax Act, 1961 are properly and correctly calculated, so that the income assessable can be computed correctly.

OUR APPROACH INVOLVES THE FOLLOWING: -

- Certification of the books of account being in agreement with the Balance Sheet and Profit and Loss Account as per the requirements of the Income Tax Act, 1961.

- Checking the correctness of the Claimable deductions as allowed in the Income Tax Act, 1961.

- Effective reviews to see that the accounts are prepared in accordance with the tax efficient policies.

- Checking the various tax compliance norms as set out by the Income Tax Act, 1961.

- Issuing the Report of Tax Audit as required by the Income Tax Rules in the prescribed format.

- Preparation and filing of income-tax returns for Companies and other entities with the Revenue authorities.

We can help you develop tax efficient strategies and manage your tax exposures considering your individual business needs. We will keep you abreast of new developments in the Indian corporate taxation arena that affect your business.

Tax Audit is a conditional audit, conducted under the regulations of Income Tax Act.,

Tax Audit FAQ

Tax audit is conducted to achieve the following objectives:

- Ensureproper maintenance and correctness of books of accounts and certificationof the same by a tax auditor

- Reportingobservations/discrepancies noted by tax auditor after a methodicalexamination of the books of account

- Toreport prescribed information such as tax depreciation, compliance ofvarious provisions of income tax law etc.

All these enable tax authorities in verifying the correctness of incometax returns filed by the taxpayer. Calculation and verification of totalincome, claim for deductions etc. also becomes easier.

Is Audit under Income Tax Act mandatory?

As per Section 44AB of the Income Tax Act, 1961, certain persons carrying on business or profession have to get their books of accounts audited by a practicing Chartered Accountant.

In case of business, if the total sales, turnover or gross receipts, as the case may be, exceed or exceeds 1 Crore Rupees in any previous year and

In case of profession, if the gross receipts in profession exceed Rs.50 lakh Rupees in any previous year are compulsorily required to get their books of accounts audited by a Chartered Accountant.

The only exemption here is if the enterprise has opted for the presumptive taxation scheme, then the entity does not have to get its books of accounts audited. But this scheme is not applicable for Companies, which means for every company whose turnover crosses Rs.1 Crore for the financial year, has to get its books of account audited.

The applicable entities have to get their accounts audited by a Chartered Accountant before the specified date and furnish the report of such audit.

In order to reduce the compliance burden on small and medium enterprises, it is proposed to increase the threshold limit for a person carrying on business from one crore to five crore rupees(FY 20-21) in case where,

(i) Aggregate of all receipts in cash during the previous year does not exceed five percent of such receipt, and

(i) Aggregate of all payment in cash during the previous year does not exceed five percent of such payment.

What is ICDS? For whom it is applicable?

ICDS refers to Income Computation and Disclosure Standards. The Central Government has notified ten ICDS applicable with effect from Assessment Year 2017-18 for the purpose of computation of Income under the head “Profits and gains of business or profession” and “Income from other Sources”

ICDS is applicable to all taxpayers, irrespective of turnover, including firms, AOP, Resident or Non-Residents, etc.,) who have income from business or profession or Income from other sources

Penalty of non filing or delay in filing tax audit report

If any taxpayer who is required to get the tax audit done but fails to do so, the least of the following may be levied as a penalty:

1. 0.5% of the total sales, turnover or gross receipts

2. Rs 1,50,000

Information System Audit

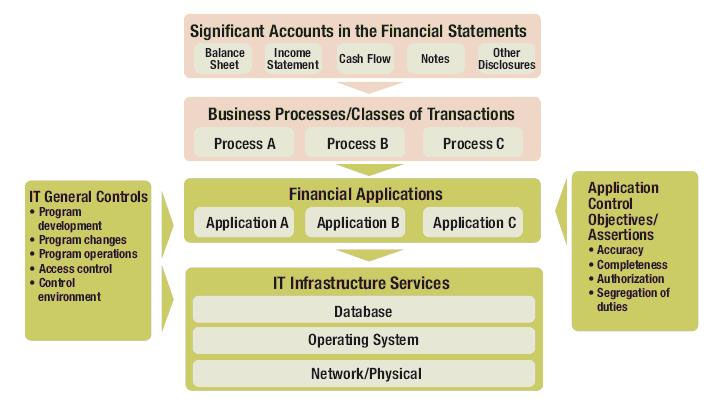

An information system (IS) audit or information technology (IT) audit is an examination of the controls within an entity's Information technology infrastructure. These reviews may be performed in conjunction with a financial statement audit, internal audit, or other form of attestation engagement. It is the process of collecting and evaluating evidence of an organization's information systems, practices, and operations. Obtained evidence evaluation can ensure whether the organization's information systems safeguard assets, maintains data integrity, and are operating effectively and efficiently to achieve the organization's goals or objectives.

An IS audit is not entirely similar to a financial statement audit. An evaluation of internal controls may or may not take place in an IS audit. Reliance on internal controls is a unique characteristic of a financial audit. An evaluation of internal controls is necessary in a financial audit, in order to allow the auditor to place reliance on the internal controls, and therefore, substantially reduce the amount of testing necessary to form an opinion regarding the financial statements of the company. An IS audit, on the other hand, tends to focus on determining risks that are relevant to information assets, and in assessing controls in order to reduce or mitigate these risks. An IT audit may take the form of a "general control review" or an "specific control review". Regarding the protection of information assets, one purpose of an IS audit is to review and evaluate an organization's information system's availability, confidentiality, and integrity by answering the following questions:

- Will the organization's computerized systems be available for the business at all times when required? (Availability)

- Will the information in the systems be disclosed only to authorized users? (Confidentiality)

- Will the information provided by the system always be accurate, reliable, and timely? (Integrity)